Currency exchange. The phrase conjures images of bustling airport kiosks, international vacations, and complex financial transactions. But what does it really mean to exchange currency, and how can you navigate the world of foreign exchange with confidence and get the best possible rates? Whether you’re a seasoned traveler, an international business owner, or simply curious about global economics, understanding currency exchange is essential. This guide provides a comprehensive overview, covering everything from the basics to advanced tips and strategies.

Understanding Currency Exchange Basics

What is Currency Exchange?

Currency exchange, also known as foreign exchange (forex or FX), is the process of converting one country’s currency into another. This process is necessary for international trade, travel, and investment. The price at which one currency can be exchanged for another is known as the exchange rate. Exchange rates fluctuate constantly due to a variety of factors, including economic performance, political stability, and market sentiment.

- Currencies are typically identified by a three-letter code, such as USD (United States Dollar), EUR (Euro), GBP (British Pound), and JPY (Japanese Yen).

- The currency market is the largest and most liquid financial market in the world, with trillions of dollars changing hands daily.

- Understanding the concept of “base currency” and “quote currency” is crucial. For example, in the EUR/USD pair, the EUR is the base currency and the USD is the quote currency. This means the exchange rate represents how many USD are needed to buy one EUR.

Factors Influencing Exchange Rates

Many factors impact currency exchange rates, making it a dynamic and often unpredictable market. Understanding these influences can help you make more informed decisions.

- Economic Indicators: Key economic indicators, such as GDP growth, inflation rates, unemployment figures, and interest rates, significantly influence exchange rates. For example, a country with strong GDP growth and rising interest rates is likely to see its currency appreciate.

- Political Stability: Political instability, such as elections, coups, or geopolitical tensions, can negatively impact a currency’s value. Investors tend to seek safer havens during times of uncertainty.

- Central Bank Policies: Central banks play a critical role in managing exchange rates through interventions, such as buying or selling their own currency in the foreign exchange market, and by setting monetary policy.

- Market Sentiment: Speculation and market sentiment can also drive exchange rate movements. News events, rumors, and even herd behavior can lead to rapid fluctuations.

- Supply and Demand: Like any market, the law of supply and demand applies to currencies. Increased demand for a currency will push its value up, while increased supply will push it down.

Different Types of Exchange Rates

Exchange rates come in various forms, each with its own implications for transactions.

- Spot Rate: The spot rate is the current exchange rate for immediate delivery of a currency. This is the rate you’ll typically see quoted online or at currency exchange kiosks.

- Forward Rate: A forward rate is an exchange rate agreed upon today for a transaction that will take place at a future date. This is often used by businesses to hedge against currency risk.

- Fixed Exchange Rate: Some countries operate under a fixed exchange rate regime, where their currency is pegged to another currency or a basket of currencies. This provides stability but limits monetary policy flexibility.

- Floating Exchange Rate: Most major currencies operate under a floating exchange rate regime, where their value is determined by market forces of supply and demand.

Where to Exchange Currency

Banks and Credit Unions

Banks and credit unions are a common place to exchange currency, but they often offer less competitive exchange rates compared to other options. They typically charge fees or commissions in addition to the exchange rate markup.

- Pros: Convenient, familiar, and generally reliable.

- Cons: Higher fees and less favorable exchange rates compared to specialized currency exchange services.

- Tip: Check with your bank or credit union in advance to see if they offer currency exchange services and what their rates and fees are.

Currency Exchange Kiosks

Currency exchange kiosks are frequently found in airports, train stations, and tourist areas. While convenient, they often offer the worst exchange rates and charge high fees.

- Pros: Easily accessible, especially in travel hubs.

- Cons: Highest fees and least favorable exchange rates. Avoid using them if possible.

- Example: An airport kiosk might offer an exchange rate that’s 5-10% worse than the interbank rate (the rate banks use to trade with each other).

Online Currency Exchange Services

Online currency exchange services are becoming increasingly popular due to their competitive exchange rates and lower fees. Many services allow you to transfer funds electronically or have currency delivered to your home.

- Pros: Competitive exchange rates, lower fees, convenience.

- Cons: May require an account and verification process. Potential for scams if using an unfamiliar service.

- Examples: Wise (formerly TransferWise), OFX, Remitly.

Forex Brokers

Forex brokers provide platforms for trading currencies. While this can offer the potential for profit, it also involves significant risk and is best suited for experienced traders. Trading currencies involves leverage, which can amplify both gains and losses.

- Pros: Potential for profit through trading, access to advanced tools and analysis.

- Cons: High risk of loss, requires significant knowledge and experience. Not suitable for beginners.

- Important Note: Trading forex involves significant risk and is not suitable for everyone.

Tips for Getting the Best Exchange Rates

Research and Compare Rates

Before exchanging currency, take the time to research and compare rates from different providers. Use online tools and websites to check the current exchange rates and identify the best deals.

- Use websites like Google Finance, XE.com, or Bloomberg to check the current mid-market rate (the average of the buy and sell rates).

- Compare the rates offered by different banks, online services, and currency exchange kiosks.

- Be wary of services that advertise “no fees” or “0% commission,” as they often make up for it with less favorable exchange rates.

Avoid Airport Kiosks

Airport kiosks are notorious for offering the worst exchange rates and charging high fees. Avoid using them if possible. If you need currency immediately upon arrival, consider exchanging a small amount and then finding a better rate elsewhere.

- Consider using an ATM at your destination instead. ATMs typically offer more favorable exchange rates than airport kiosks, although they may charge fees.

- Order currency online in advance and have it delivered to your home or pick it up at a local branch.

Use Credit Cards Wisely

Using a credit card for purchases in a foreign country can be convenient, but it’s important to be aware of the potential fees. Some credit cards charge foreign transaction fees, which can add 1-3% to your purchase.

- Look for credit cards with no foreign transaction fees.

- Be aware of the exchange rate your credit card company will use.

- Consider using a travel credit card that offers rewards and benefits for international travel.

Consider Timing

Exchange rates fluctuate constantly, so timing can play a role in getting the best rate. However, trying to time the market is difficult and risky.

- Keep an eye on the news and economic events that could impact exchange rates.

- Consider exchanging currency when the exchange rate is favorable for you.

- Don’t try to time the market perfectly, as it’s nearly impossible to predict short-term fluctuations.

Negotiate, if Possible

In some cases, it may be possible to negotiate the exchange rate, especially when exchanging large amounts of currency. This is more likely to be successful at banks or specialized currency exchange services.

- Ask if they offer a better rate for large transactions.

- Be polite and professional when negotiating.

Common Currency Exchange Scams

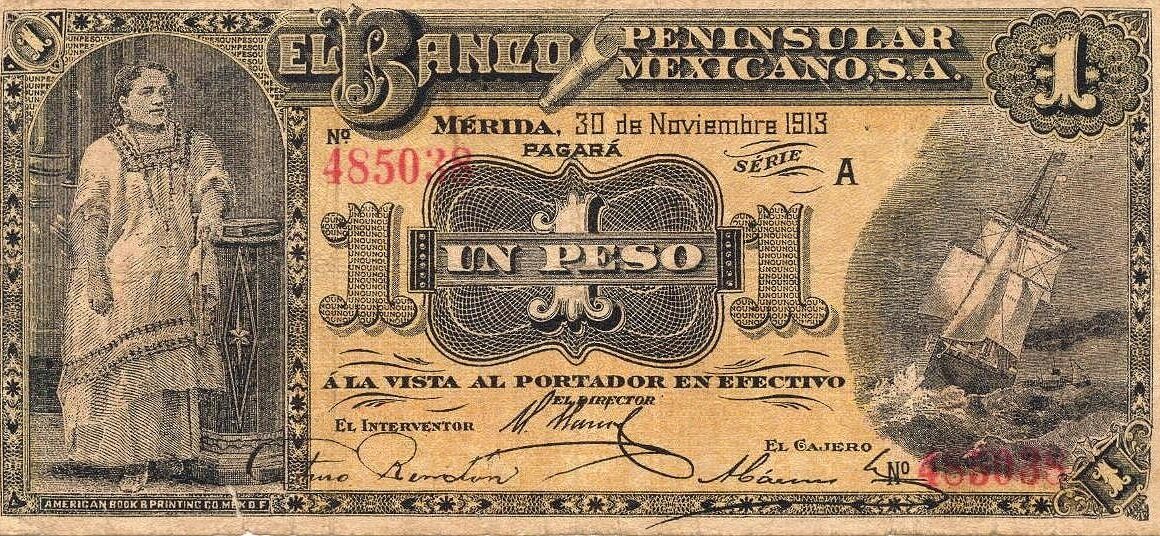

Counterfeit Currency

Always be vigilant when exchanging currency, especially from unofficial sources. Counterfeit currency is a serious problem in some countries.

- Examine the currency carefully for signs of counterfeiting, such as poor printing quality, lack of security features, or unusual colors.

- Use reputable currency exchange services.

- Avoid exchanging currency on the street.

Hidden Fees

Some currency exchange services may try to hide fees or commissions in the exchange rate or charge unexpected fees at the last minute.

- Always ask for a clear breakdown of all fees and commissions before exchanging currency.

- Be wary of services that advertise “no fees” or “0% commission,” as they may make up for it with less favorable exchange rates.

Bait-and-Switch Tactics

Some services may advertise an attractive exchange rate but then claim it’s no longer available when you try to exchange currency.

- Confirm the exchange rate before proceeding with the transaction.

- Be wary of services that pressure you to exchange currency quickly.

Online Scams

Be cautious of online currency exchange services that offer unrealistically good exchange rates or require you to send money through unconventional methods.

- Research the service thoroughly before using it.

- Check for reviews and ratings from other users.

- Use a secure payment method.

- Never send money through unconventional methods, such as Western Union or MoneyGram, to someone you don’t know.

Conclusion

Navigating the world of currency exchange can seem daunting, but with the right knowledge and strategies, you can ensure you get the best possible rates and avoid common pitfalls. By understanding the basics of currency exchange, researching your options, and being aware of potential scams, you can confidently manage your currency exchange needs for travel, business, or investment. Remember to compare rates, avoid airport kiosks, and use reputable services. With a little planning, you can save money and enjoy a smoother international experience.