Cryptocurrency, a digital or virtual form of currency that uses cryptography for security, has exploded in popularity over the last decade. From Bitcoin’s humble beginnings to the proliferation of thousands of altcoins, the world of crypto is constantly evolving and increasingly impacting global finance. Understanding the fundamentals of cryptocurrency, its applications, and potential risks is crucial for anyone looking to participate in this innovative space.

What is Cryptocurrency?

Decentralized Digital Currency

Cryptocurrency is fundamentally a decentralized digital currency. Unlike traditional currencies issued by central banks, cryptocurrencies operate on a distributed ledger technology called blockchain. This means no single entity controls the currency, making it resistant to censorship and single points of failure.

- Decentralization: No central authority governs the cryptocurrency network.

- Cryptography: Uses advanced encryption techniques to secure transactions.

- Blockchain: A public, distributed ledger that records all transactions.

- Example: Bitcoin’s blockchain records every transaction ever made, making it transparent and verifiable. This transparency, while sometimes a concern for privacy advocates, provides a high level of security.

How Cryptocurrency Works

Cryptocurrencies rely on blockchain technology to verify and record transactions. Transactions are grouped into “blocks” which are then cryptographically linked together, forming a “chain.” This chain is distributed across a network of computers (nodes) that constantly verify and update the ledger.

- Mining/Staking: Mechanisms to validate transactions and add new blocks to the blockchain (depending on the specific cryptocurrency).

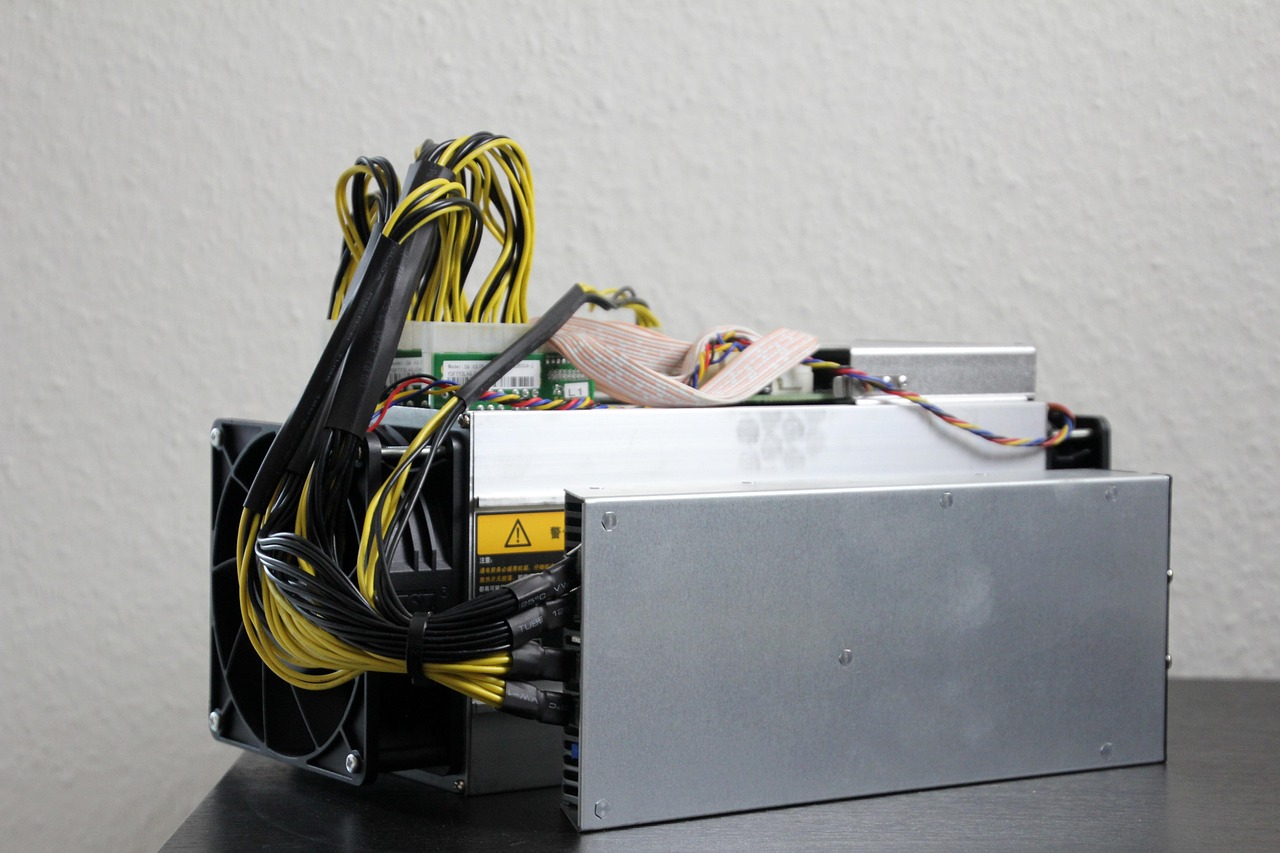

Proof-of-Work (PoW): Miners compete to solve complex mathematical problems. The first to solve the problem adds a new block to the chain and is rewarded with cryptocurrency (e.g., Bitcoin).

Proof-of-Stake (PoS): Users stake their cryptocurrency to validate transactions. Selected validators are rewarded with transaction fees or newly minted coins (e.g., Ethereum, post-Merge).

- Wallets: Digital wallets store the cryptographic keys needed to access and manage your cryptocurrency.

Hot Wallets: Connected to the internet; convenient but less secure.

Cold Wallets: Stored offline; more secure but less convenient.

- Example: When you send Bitcoin from your wallet to another user, the transaction is broadcast to the network. Miners or stakers then verify the transaction, group it into a block, and add it to the blockchain.

Key Features of Cryptocurrency

Cryptocurrencies offer several advantages over traditional financial systems:

- Transparency: All transactions are recorded on a public ledger.

- Security: Cryptography makes transactions very difficult to counterfeit or reverse.

- Faster Transactions: Cross-border payments can be significantly faster than traditional bank transfers.

- Lower Fees: Transaction fees can be lower compared to traditional financial institutions, especially for international transfers.

- Accessibility: Can provide access to financial services for individuals who are unbanked or underbanked.

- Data Point: A 2021 survey by the Federal Reserve found that 6% of U.S. adults held or used cryptocurrency, highlighting its growing adoption.

Investing in Cryptocurrency

Risks and Rewards

Investing in cryptocurrency can be both rewarding and risky. The volatile nature of the market means that prices can fluctuate dramatically in short periods.

- Potential Rewards:

High Growth Potential: Some cryptocurrencies have experienced significant price appreciation.

Diversification: Can diversify an investment portfolio.

Early Adoption: Opportunity to invest in emerging technologies.

- Potential Risks:

Volatility: Prices can fluctuate wildly.

Regulation: Regulatory uncertainty can impact prices and adoption.

Security: Vulnerable to hacking and theft if not stored properly.

Scams: Many fraudulent projects and schemes exist in the crypto space.

Loss of Value: Project failure or lack of adoption can lead to significant losses.

- Example: Bitcoin experienced a significant price surge in 2021, reaching an all-time high before subsequently falling dramatically. This illustrates the inherent volatility of the crypto market.

Due Diligence and Research

Before investing in any cryptocurrency, it’s crucial to conduct thorough research and due diligence.

- Understand the Technology: Learn about the underlying technology and its use cases.

- Evaluate the Team: Research the team behind the project and their track record.

- Analyze the Tokenomics: Understand the supply and distribution of the cryptocurrency.

- Read Whitepapers: Review the official whitepaper to understand the project’s goals and roadmap.

- Assess the Community: Evaluate the community support and engagement.

- Tip: Use reputable cryptocurrency news sources, analytics platforms, and community forums to gather information. Be wary of hype and misinformation.

Portfolio Management

Proper portfolio management is essential to mitigate risk.

- Diversification: Don’t put all your eggs in one basket. Invest in a variety of cryptocurrencies.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals to average out the purchase price.

- Set Stop-Loss Orders: Automatically sell your cryptocurrency if it falls below a certain price.

- Rebalance Regularly: Periodically adjust your portfolio to maintain your desired asset allocation.

Practical Applications of Cryptocurrency

Beyond Speculation

While cryptocurrency is often associated with speculation, it has numerous practical applications.

- Cross-Border Payments: Facilitates faster and cheaper international money transfers.

- Decentralized Finance (DeFi): Enables lending, borrowing, and trading without intermediaries.

- Supply Chain Management: Improves transparency and traceability of goods.

- Identity Management: Provides secure and verifiable digital identities.

- Non-Fungible Tokens (NFTs): Represents ownership of unique digital assets.

- Example: Ripple (XRP) aims to provide a faster and more efficient payment system for financial institutions, using blockchain technology to facilitate cross-border transactions.

Decentralized Finance (DeFi) Explained

DeFi aims to recreate traditional financial services in a decentralized manner.

- Decentralized Exchanges (DEXs): Allows users to trade cryptocurrencies directly with each other without intermediaries.

- Lending and Borrowing Platforms: Enables users to lend out their cryptocurrency to earn interest or borrow cryptocurrency by providing collateral.

- Yield Farming: Allows users to earn rewards by providing liquidity to DeFi protocols.

- Example: Aave is a popular DeFi lending platform where users can earn interest on their cryptocurrency deposits or borrow cryptocurrency by providing collateral.

NFTs and the Creator Economy

Non-Fungible Tokens (NFTs) have gained popularity as a way to represent ownership of unique digital assets.

- Digital Art: Allows artists to sell their digital art directly to collectors.

- Collectibles: Creates digital scarcity for collectibles, such as trading cards.

- Gaming: Enables in-game assets to be owned and traded by players.

- Music: Allows musicians to tokenize their music and connect directly with fans.

- Example: Beeple’s NFT artwork “Everydays: The First 5000 Days” sold for $69 million at Christie’s auction, demonstrating the potential value of digital art.

Regulation and the Future of Cryptocurrency

The Regulatory Landscape

The regulatory landscape for cryptocurrency is evolving rapidly. Different countries have taken different approaches, ranging from outright bans to embracing innovation.

- Varying Approaches:

China: Has banned cryptocurrency trading and mining.

United States: Is exploring various regulatory frameworks for cryptocurrency.

European Union: Is developing comprehensive regulations for cryptocurrency assets.

- Key Regulatory Concerns:

Money Laundering: Preventing the use of cryptocurrency for illicit activities.

Investor Protection: Protecting investors from scams and market manipulation.

Taxation: Ensuring that cryptocurrency gains are properly taxed.

Financial Stability: Assessing the potential impact of cryptocurrency on the financial system.

- Tip: Stay informed about the regulatory developments in your jurisdiction.

The Future of Cryptocurrency

The future of cryptocurrency is uncertain but promising.

- Increased Adoption: Continued adoption by individuals and institutions.

- Mainstream Integration: Integration into traditional financial systems.

- Technological Advancements: Development of new technologies and applications.

- Regulatory Clarity: Clearer and more consistent regulatory frameworks.

- *Prediction: Experts predict that cryptocurrency will continue to play an increasingly important role in the global economy, particularly in areas such as cross-border payments, decentralized finance, and digital identity. The increasing institutional interest will continue to play a major role in stabilizing the crypto markets.

Conclusion

Cryptocurrency represents a paradigm shift in the world of finance. While it presents significant investment opportunities, it also comes with inherent risks that require careful consideration. By understanding the technology, conducting thorough research, and practicing sound risk management, individuals can navigate the crypto landscape successfully. The future of cryptocurrency hinges on continued innovation, wider adoption, and the establishment of clear and supportive regulatory frameworks, paving the way for its integration into the mainstream financial system.